There is always a bull market somewhere – Jim Cramer.

It’s quite counterintuitive, but the above quote is true (leaving our opinion about its author aside). Although the whole Market may be in a full downward swing, there is always a sector, which works its way up.

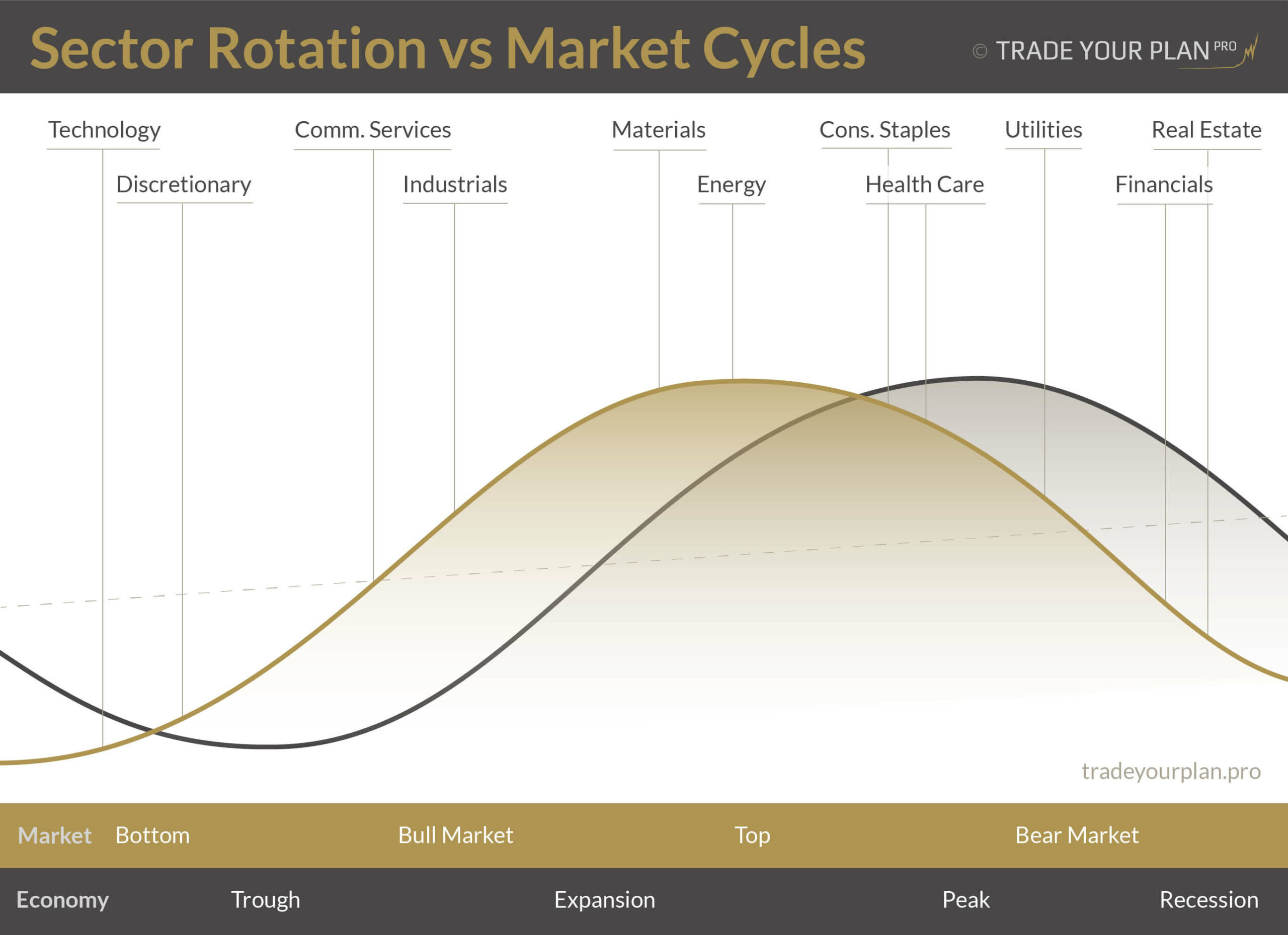

The economy turns in cycles. And so does the Market, but as a Discounting Mechanism – it actually proceeds the moves of the economy. In each stage of the cycle – expansion, peak, recession and trough – there are different industry sectors profiting due to the macroeconomic circumstances. The best performing industry sectors rotate in a very repetitive pattern. Being aware of this pattern may be very profitable for investors.

Sector Rotation

In order to analyse the rotation of sectors within a Market Cycle we can use the relative performance of the eleven S&P Sector ETFs. That information, in turn, may help predict which sectors will strengthen in the coming weeks and months.

The idealised Market Rotation is presented on the image below:

Sector Rotation vs Market Cycles. © TradeYourPlan.PRO

The graph above positions the best performing sectors within a Market Cycle (the golden line). It also emphasises the market’s lead over the economic cycle. The center line – which is the contraction/expansion threshold for the cycle – is inclined, as the whole economy advances in the long run.

Technology is the first to turn up in anticipation of a bottom in the economic cycle. It is soon followed by Consumer Discretionary stocks (luxury goods). These are two leaders of a new bull stock market.

Energy and Materials are the best performers on the top of the market cycle. They benefit from a rise in commodity prices and a rise in demand from an expanding economy.

At some point high input costs (the costs incurred to create a product or service) start to hurt the economy though. The products are getting more expensive. People start spending less on luxury and more on basic goods. At this point the Consumer Staples stocks tend to outperform the general market.

The market peak and downturn are followed by a contraction in the economy. At this stage, the Central Banks start to lower interest rates to boost demand. Falling interest rates translate to lower mortgage rates – which benefits the Real Estate market.

The steepening yield curve also improves profitability of Financial institutions. Low interest rates and easy money eventually lead to a market bottom and the cycle repeats itself.

This theoretical model is based on Sam Stovall’s S&P’s Guide to Sector Rotation.

Present Market

Resources

Finviz – Groups – is a convenient page to compare the performance of all sectors. Clicking any sector’s chart gives the list of stocks that make it up.

StockCharts – presents all the sectors on one chart. Good for a quick view.